So you want to be a property investor, but don’t have enough money. This really isn’t a big deal! I’ve never met a property investor that thinks they have enough money. But help is at hand! In the UK, there are so many solutions to help you finance your property portfolio. If you only have a small amount of money, there’s probably a good solution for you.

I’ve been investing in property for the past 15 years (I felt old writing that!) and have learned a lot. One standout lesson, is if you can finance your property purchase, then you’re the king of all you survey. If you rely on mortgages with 75% Loan to Value, then you’ll hit a wall pretty fast. You need to get creative to grow further.

As I mentioned above, every investor thinks they don’t have enough money. This is especially powerful coming from me. In my corporate career, I’ve spent 20 years in investment banking. Even in high paying jobs, property investors hit a wall pretty fast. I have contemporaries that have earned huge sums of money. I know people that have earned millions, but only had 5 properties by the age of 40. They bought expensive properties in London with low yields and 75% mortgages. Yet I’ve worked with investors with far less money and far more properties.

In this article I’ll provide 11 creative ways to finance your property portfolio. You can use these tools to start a property portfolio with limited funds or to grow your portfolio when you run out of money. I’ll cover basic tools like mortgages and ISAs, and then I’ll look at more complex methods of finance. If you can master half of the techniques here, then you’ll be an ace property investor.

But first, let me talk about some strategies to avoid!

My Youtube is full of fake gurus telling me how to buy properties without any money. The solutions they mention are typically crap (unlike the solutions in this article). And guess what, they normally have an expensive course to sell. I’ll detail a couple of crappy strategies you should avoid.

Rent to Rent

You’ve probably heard of rent to rent. It’s where you rent a property from the owner and then rent it to a tenant at a higher price. You then take the profit in between. As you don’t own the properties, you can take quickly take control of many properties and grow your income. What’s not to like? Quite a lot actually

- You aren’t likely to make a large profit on each property. Why would a property owner offer the property to you for cheap, when they could rent it out to the tenant themselves?

- This strategy is a lot of work. Each property will require you to conduct viewings and manage it. You’re trading your time for not a lot of money

- The strategy is basically a house of cards. If one property is empty for a month, then you could destroy all of the profits from the rest of your portfolio

- As you don’t own the property, you won’t benefit from capital appreciation

Deal Packaging

Deal packaging is sometimes called deal sourcing. It’s where you find great properties for other people and charge them a fee. It’s sold as a dream to property investors, to enable you to build up your funds from nothing. Unfortunately, it’s basically a nonsense. I’ve never met a ‘deal sourcer’ who could find a better property than I could. Most of them mindlessly forward properties from estate agents and are then surprised when people don’t want to pay them a fee.

Lets be clear, if someone knows how to find a great property deal (e.g. a BRRRR or commercial deal), then they’re not finding those properties for a £1,000 fee. They’re buying the properties themselves or partnering with professional investors and doing a JV (I’ll explain below!).

The simplest method of financing a property purchase is by using cash, i.e. self fund the entire purchase. I don’t recommend to buy properties with cash. Always try to arrange some financing.

If you use cash, it’s going to take you a long time to buy enough properties to be financially free. Buying in cash is only suitable if you already have large funds available to you.

If you’re reading this blog, you probably know what a mortgage is! I’ll quickly summarise the features of a mortgage.

A mortgage is a loan that is secured against a property. It’s designed for long term lending and has the lowest interest rates of virtually any type of loan. Residential mortgages often have interest rates of less that 1%. It’s the most popular way to finance a property purchase. I wrote a detailed article about buy to let mortgages.

You may not know this, but you can own commercial property inside your pension. This can be a really great way to grow your property portfolio. Many people have large pension pots invested in underperforming mutual funds. If you can switch your pension into a commercial property with a 10% yield, then that’s a pretty good win.

A lifetime ISA is a product you can use to help purchase a property. Essentially you save money inside the lifetime ISA, and the Government will top up your funds. In return for the generosity of the UK Government, there are limits to the ISA. The money in the lifetime ISA can only be used to purchase a property or for retirement.

One solution to not having enough funds is to buy a cheaper property. This is an extremely powerful solution and is very popular with investors.

These days, you’ll be hard pressed to get a decent property in London for under £500,000. This situation is very different in other parts of the country. In the North East and the North West, you can find great investment properties for under £100,000.

You’ll also benefit from lower rates of stamp duty. On a £500,000 buy to let property, stamp duty will cost you £30,000. For a buy to let property of £100,000, only £3,000 of stamp duty is payable. If you want to find out more, then the below two articles can help.

Bridging finance is an expensive form of financing, with rates varying from 0.5% to 2% per month. It is however very popular. This is because finance can be arranged very quickly and you can borrow against properties that wouldn’t qualify for a mortgage (e.g. a rundown building).

Given the high interest rates, bridging finance is only designed for short term borrowing needs. Bridging finance is useful for buying at auction, where there isn’t time to arrange a mortgage. It’s also useful for property flips, where you’re not allowed to use mortgages.

Development finance is a special type of property loan, where funds are extended for construction costs. You might buy a plot of land for £250,000 and take out a development finance loan for £400,000. The extra £150,000 will be used to fund the construction of the property on the land.

Development finance rates will be lower if you can demonstrate your experience in construction.

Lease options are an interesting strategy. A purchase lease option gives the investor the right to buy a property at a certain price, at a certain date in the future.

In the meantime, the investor agrees to pay the seller’s mortgage and take control of the property. Any rent they get (above the cost of the mortgage), is profit for the investor. Over time, they can save up for a deposit and then buy the property.

This can be a pretty great strategy when applied well. You can buy a property without deposit funds, and benefit from any appreciation. I wrote an article with more details about the lease option strategy.

Vendor finance is similar to a lease option, but not as well known by investors. It can be useful to fund property flips, where you don’t have the money to buy the property.

In an ordinary property flip, you buy an old property for cheap. You then renovate it and sell it at a profit. You’ll have to pay solicitor’s fees twice and also stamp duty for the purchase.

Vendor finance is where the seller of the property provides you with the finance you need. You’ll do the same work to refurbish the property, without ever owning it. When the property is sold, you can split the profits with the existing owner. The seller benefits as they will get a higher price for the property that you have refurbed. The investor benefits as they don’t have to pay stamp duty to buy the property. It’s a pretty great win-win.

Joint ventures are when you partner with someone who can fund the property purchase. The best JVs are where each partner brings something to the table. One partner can bring the funds and the other partner can bring the knowledge and do the work.

You might wonder why the person with funds can’t just buy the property themselves? That person may not have enough time or knowledge to find great property deals. If you can fill that gap, then it can be another win-win. You’d be surprised how many people out there are cash rich, but earning pittance on their money in savings accounts.

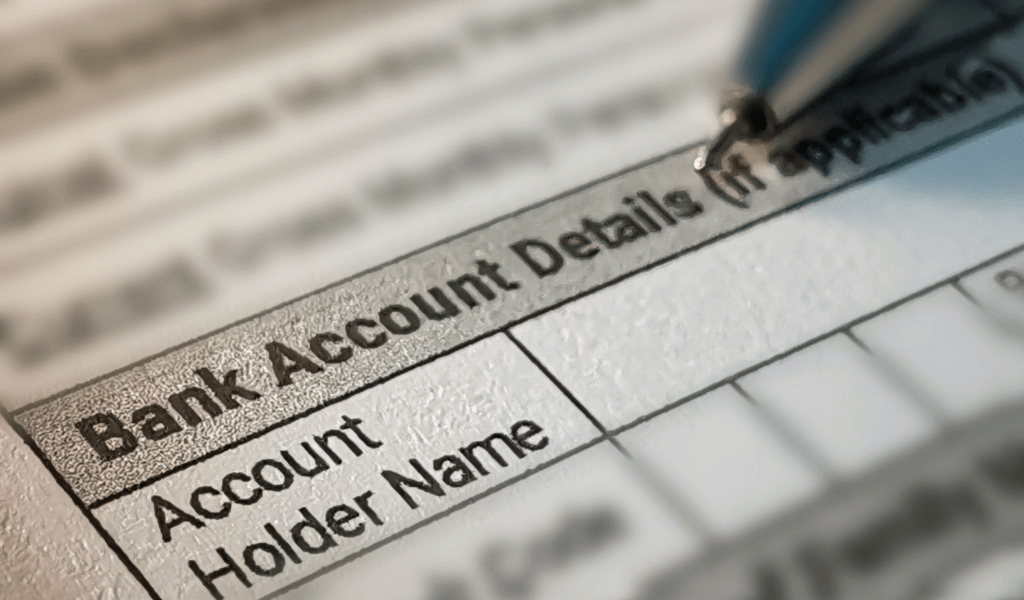

Private finance is where an individual lends you money, rather than a financial institution. Private finance is normally quite expensive (similar to bridging), and this reflects the extra risk the individual is taking.

The key to becoming a great property investor is learning how to fund your deals. If you can do that, you will be amongst the best in the field. In the UK, we are lucky to have many different solutions to fund our property purchases.

In this article I’ve given 11 of those funding solutions.

???? + 1.846199 BTC.NEXT - https://graph.org/Message--685-03-25?hs=4bdfd2b8ba40e99ec6b24e4c4155f3e0& ????

y3t9gi