I’m a massive fan of Indian real estate investment – the potential is enormous! The economy is growing at 7% per year and the population is growing fast. There’s massive infrastructure developments underway – metros, highways and luxury developments are coming.

However, the Indian real estate market can seem daunting to outsiders. Hell, it’s daunting to locals too! I often get asked how to invest in real estate in India. The information on Government websites is shockingly bad. The key thing about India is that you need to get the right advice – once you do that, a world of opportunity opens up.

So can a foreigner buy property in India? Yes you can, but you need to have some connection to India. Before buying a property, you must get your documentation in order. In this article, I discuss which documentation can be used to buy property in India.

If you want to find out more about real estate in India, then I also recommend some other articles I’ve written:

-

How to invest in Indian Real Estate. A step by step guide

-

How to finance a property purchase in India

-

Why invest in Indian real estate? It’s an historic opportunity

- How to manage a property investment in India

If you’re considering to buy a property in Mumbai, then I may be able to help. I provide an end-to-end service for foreigners to buy Mumbai property. I invest in Mumbai property, and have a network of professionals that I work with on the ground. I can provide access to property deals, estate agents, solicitors and property managers. I also provide advice and guidance through every step of the process. If you want to find out more, then go to this page or email me directly.

If you’re an Indian citizen, then you can invest in Indian real estate. This is obvious! So I’ll move on.

Foreigners who are Indian Residents can invest in Indian real estate. The scheme used for foreign residents to register is the FRRO scheme. Typically, properties purchased under a long-term business visa, cannot be sold within 3 years.

There aren’t many foreign-born people that are resident in India, but I expect this to change in future years. Multi-national companies are flooding into India, due to it’s large and well education population. In 2020, JPMorgan had 37,000 staff in India – more than 10% of its entire workforce.

OCI stands for “overseas citizen of India”. It’s available to someone that has a family connection to India. I always get asked: “can OCI’s buy property in India?” The answer is yes! Indeed, an OCI card is the most popular method for how NRI’s invest in India.

You’re eligible for an OCI card if one of the following is true:

- You were a citizen of India on 26 January 1950 or at any time thereafter

- You belonged to a territory that became part of India after 15 August 1947

- You were eligible to become a citizen of India on 26 January 1950

- You are a child or a grandchild or a great-grandchild of such a citizen

- You are a minor child of such persons mentioned above

- You are a minor child and whose both parents are citizens of India or one of the parents is a citizen of India

- Your spouse meets one of the above criteria

An OCI card allows you to invest in most types of property in India, subject to a small number of exemptions. It also grants the holder a lifetime visa to enter India. It’s a really great scheme, and if you’re eligible, you must apply for an OCI card.

I got my OCI card in 2008 and paid only £250. I applied from an Indian visa centre in London, and found the process to be relatively smooth. You can avail OCI services at centres around the world.

When you purchase a property in India, you’ll need to verify your identity. If you’re not a resident in India, then you can use foreign identity documents for this purpose. Passports and driving licenses can be used to prove your identity and your address.

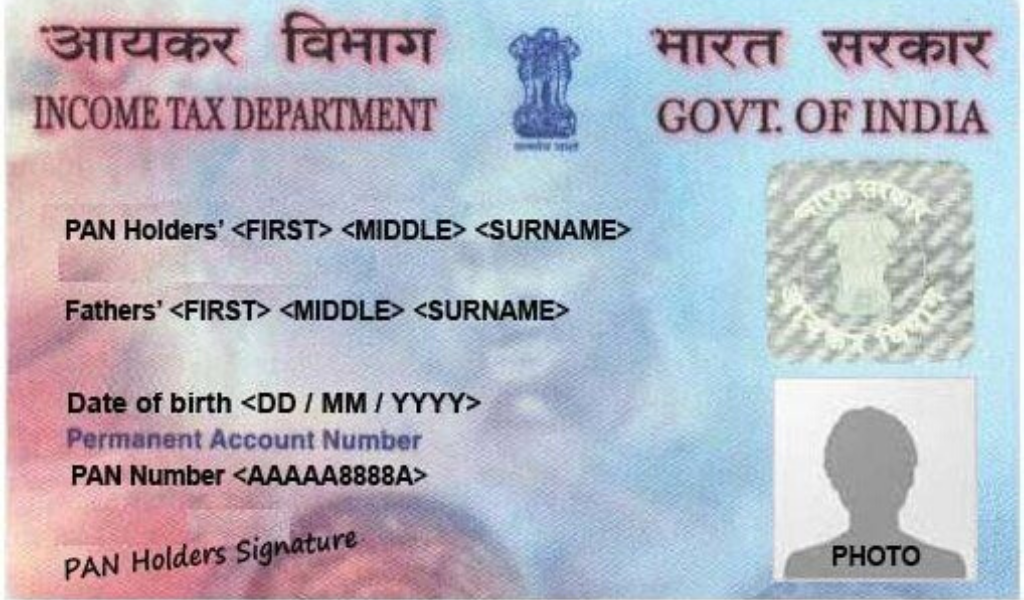

PAN stands for “Personal Account Number”, and it’s issued by the India Income Tax Department. A PAN card is issued to anyone that pays Income Tax in India. If you’re planning to invest in property in India, then you’ll need to pay income tax on your profits.

Do you need a PAN card to buy property in India? No you don’t. If you’re not a resident, then you don’t need to have a PAN card. When answering how NRI invest in India, it’s still important to know what a PAN card is however.

An Adhaar card is a voluntary identity scheme in India, that can be availed by residents. While it’s voluntary, I’ve never met anyone in India that doesn’t have an Adhaar card. It’s the main from of ID used for address proof. It’s very difficult to get an Indian sim card without an Adhaar card!

An Adhaar card isn’t necessary to buy property in India. However, once you do buy a property, I recommend to apply for an Adhaar card. Having an Adhaar card will make your life a lot easier when you go to India.

Can a foreigner buy property in India? Yes they can, but they need to get their documentation in order.

For an outsider, India can be a daunting place to invest in property. There aren’t clear guidelines on what documentation you need and Government websites are awful. In this article, I’ve summarised the main documents, and how they’ll help you to invest in property in India.

???? Reminder: Process 0.75802747 bitcoin. Assure =>> https://graph.org/GET-BITCOIN-TRANSFER-02-23-2?hs=3b45db547fc2b268d11c102b1804f2c3& ????

sxh149