Nobody made friends at a dinner party by asking “What landlord insurance do i need?”! Landlord Insurance isn’t an interesting topic, but it’s very important. It’s crucial to get the right coverage. It may take you a few hours to find the right policy, but it’s a lifesaver if something bad happens.

I’ve been fortunate with Insurance – every time I’ve made a claim, it’s been accepted without hassle. A few years ago, my bath tub was leaking water. This water got underneath the floor, and ruined a large amount of my wooden flooring. I made a claim to my buildings insurance and got paid £4,350 for the damage. At it’s best, landlord insurance provides piece of mind.

In this article, I give clear explanations and answer what landlord insurance you need. It’s a step by step guide that details the coverage you should have. I also answer some common questions:

- Is landlord insurance a legal requirement?

- What insurance do i need as a landlord in the UK?

- Best company for landlord insurance?

You can find more free education about UK property on this page. One of the most popular articles is this summary about the main buy to let taxes in the UK.

If you want to get notified of my new content, then make sure to follow me on Twitter and sign up to my email list.

So is landlord insurance a legal requirement? If you own a buy to let with a mortgage, then it probably is. The terms of your mortgage will usually state that you need to have buildings insurance.

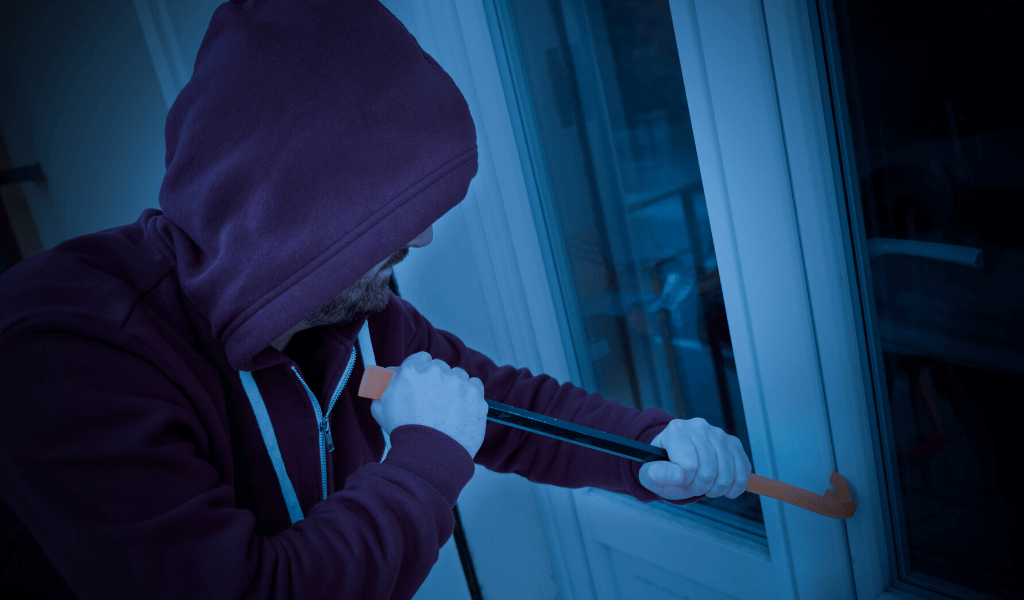

Landlord Insurance is something you pay for and hope you don’t have to use. I’ll tell you a story to explain why. A friend of mine used to rent out his flat on Airbnb. He was pretty happy doing it – he earned a lot of money and the guests would buy him gifts. That was until one of the guests made a copy of the key and then returned later to steal £5,000 of items. He didn’t have specialist Insurance and Airbnb refused to pay out, as the theft didn’t happen during an Airbnb stay. My friend was out of luck, and he took his property off Airbnb.

He made a number of errors, but in this article I’ll on focus on the Insurance side. He definitely should have taken out a specialist insurance product. I’ve also written a separate article on how to become an Airbnb host, and protect yourself against such situations.

The 1st thing to note about landlord insurance, is that you’ll need a specialist policy. An ordinary home insurance policy won’t cover your buy to let property. Home insurance is for individuals that live in the property. Your insurance policy should be specific to the activity occurring in your property. I have a property in central London on Airbnb, and I have landlord insurance have covers short let rentals. This is insurance 101 – your insurer won’t pay out if you’re doing a disallowed activity.

When buying the insurance policy, disclose as much as possible to the insurer. Be as truthful and accurate as possible – list all of your previous claims. If you need to make a claim, then the insurer will check what you’ve told them. If your disclosures weren’t accurate, then they’ll use this to as a reason to not pay you.

One fear that people have is that insurers will use any excuse to avoid paying claims. This hasn’t been my experience, but I have friends with horror stories. In the UK, insurance companies are heavily regulated. If an insurer is behaving unreasonably, then you can make a complaint to the Financial Ombudsman.

When you purchase the insurance, make sure to read the “Key Facts’ illustration. These documents are normally easy to understand. It won’t be an interesting read, but it can save you a lot of bother later on.

As a landlord, you’ll need to take out buildings insurance – mortgages normally require this. If you live in a block of flats, then there’s a good chance that a collective building insurance has been taken out. Make sure you check this with your property manager.

If you need to take out your own buildings cover, then you should have FLEA (Fire, Lightning, Explosion and Aircraft) as a minimum. Optional coverage includes flooding, escape of water, theft and subsidence. My personal view is that you should insure for as much as possible and avoid gaps in your coverage.

Escape of water is something you should definitely cover. 33% of all claims are escape of water, and I gave my own example of a bathroom leak. Make sure that the policy covers the costs of searching for the source of the leak.

Public liability insurance is a must have in your landlord insurance policy. It covers the legal costs and damages if someone has an accident on your premises.

The amount covered is often very high, e.g. £2 million or £5 million. If someone trips up on a wire and falls down the stairs, then they may paralyse themselves. They might then sue you for their care bills. Over their lifetime, these costs could run into millions.

Contents Insurance is optional, so should you do it? Well, I pay for contents insurance in my properties, although I’ve yet to make such a claim. I once heard the following definition about what is covered by contents insurance: If you turn your home upside down, your contents are what falls down.

As a landlord, you have far less contents in the property than where you live. You won’t have to worry about items like bikes, laptops and jewelry. The landlord’s contents will be mainly furniture and appliances. In my experience, it doesn’t cost a lot more to cover contents – but everyone’s situation is different.

Rental guarantee insurance (RGI) pays out if your tenant stops paying rent – it replaces the lost income. Most landlords don’t pay for RGI, and I view this as insane. I take out RGI on every property I have. The premium is around £100 per year for most of my properties, and this protects me in case the tenant stops paying rent.

With an RGI policy, look at the following features:

- How long does the tenant need to be in arrears before the policy kicks in? Go for a policy that kicks in as soon as possible

- How many months of rent will be paid out?

-

Will the policy cover the legal expenses of evicting the tenant?

The sum insured is the maximum amount an insurer will pay for a claim. So how should you choose what your sum insured is? The worst case scenario is a house fire and your property needs to be rebuilt entirely. You’d want your sum insured to be high enough to pay for this rebuild.

How much would it cost to rebuild your property? Well this amount is given on any property valuation. If you haven’t valued your property recently, then you can use an online calculator. With regards to sum insured, I think its best to be conservative and over-insure.

The size of your policy excess will affect the premium you pay. The higher your excess, the lower your insurance premium. In the example above, I got £4,350 towards the replacement of my wooden flooring. The actual cost of the work was £4,850, and I had to pay the 1st £500 myself – because my policy had an excess of £500.

For landlord insurance, I normally choose an excess of £500. You’re unlikely to make an insurance claim for a small amount, so a £500 excess will be a lot smaller than your claim. Also a policy with a £500 excess would be cheaper than one with no excess.

What’s the best company for landlord insurance? I’ll answer this by talking about which insurers you should avoid. You want to avoid insurers that make it as difficult as possible to claim. A friend of mine had a burglary at his home, and £10,000 of jewelry was taken. He made a claim to his home insurance, and they spent 1 year coming back with stupid questions: “Can we see another photo of the gold bracelet?”, “Why did you have 2 iPads at your property?”. Eventually my friend complained to the financial ombudsman and the insurer paid out.

The lesson is clear. Low cost insurers try to reject and delay claims, in the hope that you give up. These aren’t the best companies for landlord insurance.

You should avoid low cost insurers and buy from a reputable company. I’ve used AXA landlord Insurance for years and had a good experience. Their quotes are very competitive and I’ve never had any problems with making a claim. AXA is over 200 years old and they have a very good reputation in the market. AXA are regulated by the Financial Conduct Authority, Reference number: 202312.

Ultimately, it’s important to choose a long standing insurer. Don’t be fooled by super cheap quotes – it’s cheap because they’ll try to avoid paying you! In the event that something bad happens to your property, you don’t want to be dealing with shady companies.

Landlord Insurance is something all landlords need to deal with and most of us hate! If you follow the right steps and are careful, then insurance is something that provides piece of mind. You can be secure in the knowledge that you’re covered if something bad happens.

After reading this article, you should know what landlord insurance you need, if landlord insurance a legal requirement and what are the best landlord insurance companies.

D billingsley

Found your advice column very helpful and straightforward thank you ????

CpOBAtJTYE